Mexico Imposes 50% Tariffs on Indian Goods: $1 Billion Exports at Risk, Key Sectors Affected

Beginning in 2026, countries without trade agreements with Mexico, such as India, China, South Korea, Thailand, and Indonesia, will be subject to significant import tariffs. This move is intended to encourage trade partnerships and bolster Mexico's economy. The new tariffs could impact the cost of goods imported from these nations.

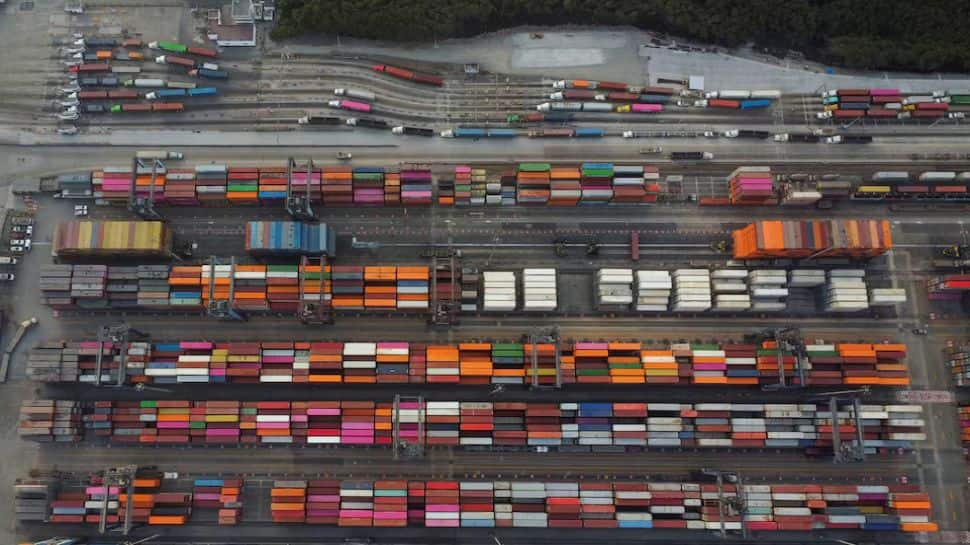

In a landmark decision, Mexico announced its plans to impose a substantial 50% tariff on imports from countries lacking trade agreements, including India. This move, set to take effect in 2026, is expected to significantly impact various sectors and threaten India’s burgeoning export market, currently valued at approximately $1 billion. The tariffs aim to foster stronger trade partnerships and stimulate the Mexican economy, but the implications for Indian exporters are considerable.

The decision comes as part of a broader strategy by the Mexican government to strengthen local industries and retain more revenue within the country. By increasing the cost of imported goods, Mexico hopes to encourage domestic production and stimulate job creation. A variety of sectors are expected to be affected, with textiles, pharmaceuticals, and consumer electronics possibly facing the biggest challenges. Given that India has been a significant supplier of these goods to the Latin American nation, this tariff may lead to increased prices and reduced competitiveness.

Industry experts are voicing concerns about the potential fallout from this move. "With such a drastic increase in tariffs, many Indian exporters will be forced to reconsider their strategies for the Mexican market," said Rajesh Kumar, director of an export-oriented firm based in Mumbai. "We have to find ways to either absorb the costs or adjust our pricing." This sentiment reflects a growing anxiety among exporters who are now grappling with the prospect of diminished profit margins.

Moreover, the tariffs are likely to encourage Mexican consumers to shift their preferences toward locally manufactured products, further complicating the landscape for Indian exporters. Sectors like textiles, which reported significant growth in exports to Mexico over the last few years, might see a drop in demand. If Indian companies cannot adapt swiftly to these changes, they risk losing their foothold in this lucrative market.

In addition to textiles, India's pharmaceutical sector, which has seen consistent demand in Mexico, could face disruptions. The imposition of high tariffs may curtail access to affordable medicines, impacting healthcare throughout Mexico. Health policy experts warn that the rising costs associated with these tariffs could lead to a detrimental effect on public health initiatives in the country, further complicating the relationship between the two nations.

As the deadline for implementation approaches, both governments must navigate the complexities of international trade relations. While Mexico's goal of bolstering its economy is commendable, the repercussions for Indian exporters cannot be overlooked. The growing tension in trade dynamics poses a challenge, as businesses on both sides seek solutions that benefit their respective economies while maintaining robust trade ties.

In conclusion, Mexico's decision to impose a 50% tariff on imports from India presents a daunting challenge for Indian exporters. With key sectors like textiles and pharmaceuticals hanging in the balance, the next few years will be crucial for navigating this evolving trade landscape. As stakeholders on both sides adapt to these changes, the future of over $1 billion in exports will undoubtedly depend on their ability to forge new pathways for collaboration in an increasingly complex global market.